ISRS – SETUP REQUIREMENTS#

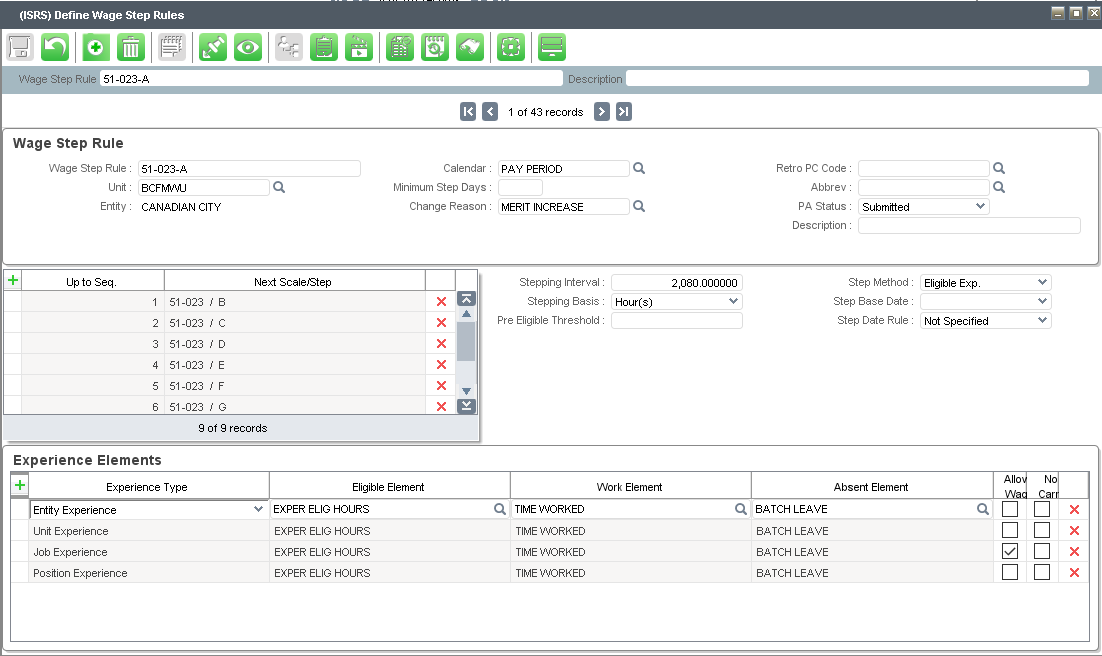

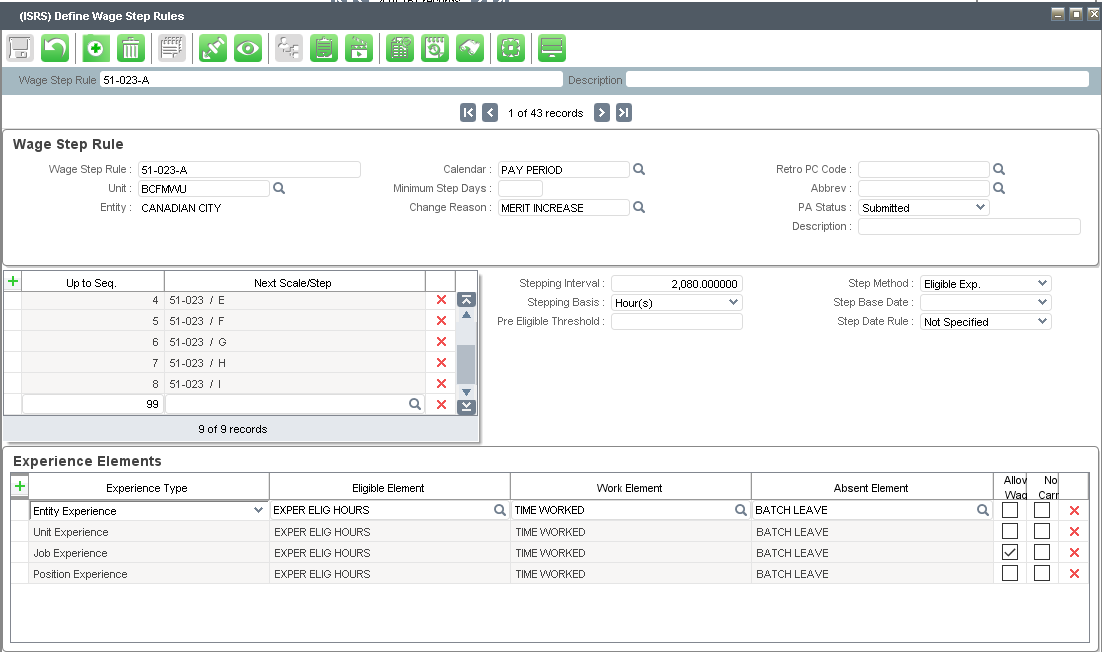

Stepping rules setup allow for wage progression requirements.

The 'Step Method' on ISRS determines what else is required to be setup on the ISRS form. For example:

- When using 'Relative Method' as the 'Step Method', the 'Step Base Date' should use a base date that changes eg., set to 'Assign Eff Date'.

- When using 'Absolute Method' as the 'Step Method', the 'Step Base Date' should use a base date that does not change eg., set to 'Job Seniority Date'.

- When using 'Eligble Exp', there is no 'Step Base Date' required, but the 'Eligible Elements' are required to be setup. This is shown in the example below.

For example, once an employee has met a threshold, they go to the step that is 5% from current step (i.e. skip a step).

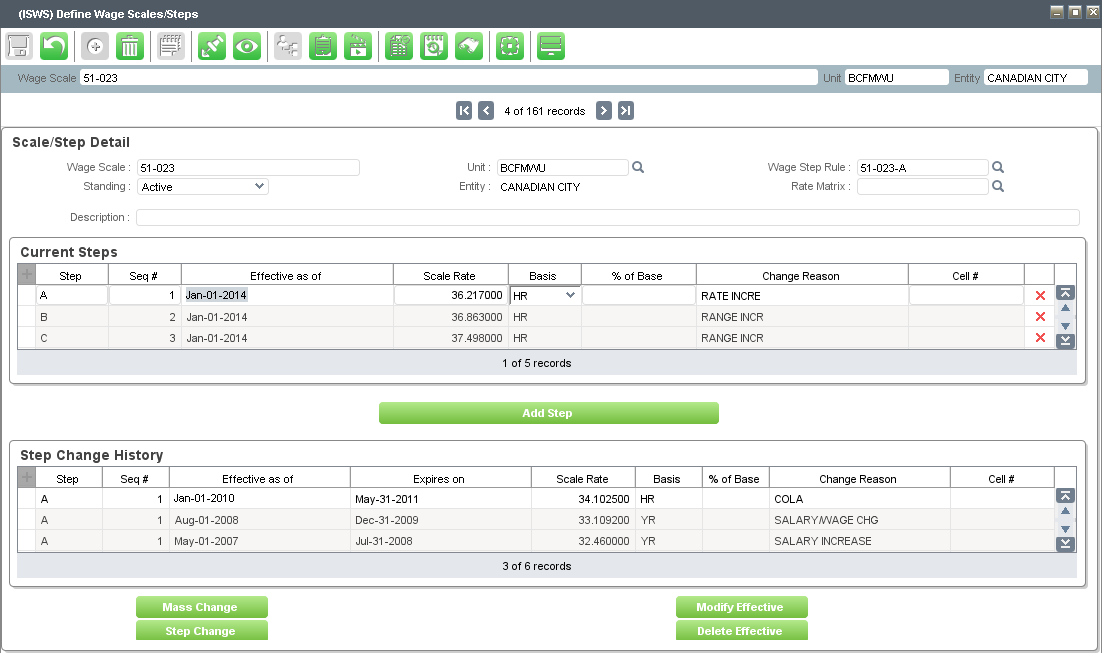

|

|

|

The Up To Seq. column represents steps up to and including the step the employee is currently on.

| ISWS | ISRS | ||

|---|---|---|---|

| Step | Seq | Seq | Next Scale/Step |

| A | 1 | 1 | B |

| B | 2 | 2 | C |

| C | 3 | 3 | D |

| D | 4 | 4 | E |

| E | 5 | 5 | F |

| F | 6 | 6 | G |

| G | 7 | 7 | H |

| H | 8 | 8 | I |

| I | 9 | 99 |

- Employee was hired into step A and meets the stepping threshold (11863)

If the employee was hired at Step A then they are on Seq 1 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 2 which corresponds to Step C on ISRS.

- Employee is currently on Step C and meets the stepping threshold (11863)

If the employee is on Step C then they are on Seq 3 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 4 which corresponds to Step E on ISRS.

- Employee was hired into Step E and meets the stepping threshold (11863)

If the employee was hired at Step E then they are on Seq 5 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 6 which corresponds to Step G on ISRS.

- Employee was hired into Step B and meets the stepping threshold (13685)

If the employee was hired at Step B then they are on Seq 2 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 3 which corresponds to Step D on ISRS.

- Employee is currently on Step D and meets the stepping threshold (13685)

If the employee is on Step D then they are on Seq 4 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 5 which corresponds to Step F on ISRS.

- Employee was hired into Step C and meets the stepping threshold (14051)

If the employee is on Step C then they are on Seq 3 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 4 which corresponds to Step E on ISRS.

- Employee is currently on Step E and meets the stepping threshold (14051)

If the employee is on Step E then they are on Seq 5 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 6 which corresponds to Step G on ISRS.

- Employee was hired into Step E and meets the stepping threshold (15157)

If the employee is on Step E then they are on Seq 5 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 6 which corresponds to Step G on ISRS.

- Employee is currently on Step G and meets the stepping threshold (15157)

If the employee is on step G then they are on Seq 7 as per the ISWS record. Once they have met the threshold hours defined on ISRS they will be stepped to Seq 8 which corresponds to Step I on ISRS.

Test using the following employees:

| Employee # | Starting IEAS Step | Updated to: | Update to: | Update to: |

|---|---|---|---|---|

| 20187 | A | C | E | G |

| 20189 | B | D | F | H |

| 20190 | C | E | G | I |

| 20191 | D | F | H | I |

| 20192 | E | G | I | - |

| 20193 | F | H | I | - |

| 20194 | G | I | - | - |

| 20195 | H | I | - | - |

| 20196 | I | - | - | - |

If the employee is on step H, and there is no Step J, they will go to step I and remain on I.

Notes #

Click to create a new notes pageScreen captures are meant to be indicative of the concept being presented and may not reflect the current screen design.

If you have any comments or questions please email the Wiki Editor

All content © High Line Corporation