(HR 6201) Emergency Paid Sick Program (E-SICK)#

Overview #

New Legislation may necessitate setup of both a Temporary Expansion of FMLA and an Emergency Sick Leave. The Legislation is expected to go into effect on April 1, 2020 and apply until December 31, 2020.

Clients should determine how to comply with this legislation and then NEOGOV can assist them with different configuration options.

To learn more, please read the Legislative Bill .

.

This document covers the setup of Emergency Sick Leave.

Table of Contents

- (HR 6201) Emergency Paid Sick Program (E-SICK)

- Overview

- Creation of Emergency Paid Sick Program

- Overview

- General Notes

- Sick Leave Reasons

- Full Time Equivalent Wages

- SetUp

- New User Variables (IMVR)

- New Pay Components (IPPC)

- New Leave Type (IAPT)

- New Statistic Code (IDSC)

- New Attendance UserCalc (IMUC)

- New Leave Policy (IALP)

- New Time Codes (IDTC)

- New payroll UserCalc (IMUC)

- Update Pay Point (IPPP)

- UPCALC Exception Messages

- Sample Configuration:

- Notes

Creation of Emergency Paid Sick Program#

Overview #

This is the configuration required for the payroll processing, time collection and capping the earnings maximums based on maximum employee rates. Please see the attached document here for a sample E-Sick policy set up on IALP leave policy.General Notes#

- FT employees could be eligible for 80 hours

- PT employees have a pro-rated entitlement.

- Part-time employees are entitled to the number of hours of paid sick time equal to the number of hours they work, on average, over a 2-week period.

- Approach – prorate the PT employees’ entitlement based on their work assignment’s FTE, otherwise enter the hours to be granted on the employee’s statistic records (IEST). The Stat will be used as an override. Whether or not an employee is eligible would be handle outside of the system.

- Part-time employees are entitled to the number of hours of paid sick time equal to the number of hours they work, on average, over a 2-week period.

- In the case of leaves to care for a family member or child, however, the required sick pay is based on 2/3rds of the regular rate of pay.

- For part-time employees whose schedule varies from week to week, special rules apply to calculate the average number of hours.

- The maximum amount of required sick pay per employee is $511 per day and $5,110 in the aggregate.

- In the case of leaves to care for a family member of child, however, the maximum amount of required sick pay per employee is $200 per day and $2,000 in the aggregate

- All unused leave expires December 31, 2020. No payout at separation.

Sick Leave Reasons #

Emergency paid sick leave will be available for an employee who is unable to work or work remotely because:

- The employee is subject to a federal, state, or local quarantine or isolation order related to COVID-19;

- The employee has been advised by a health care provider to self-quarantine because of COVID-19;

- The employee is experiencing symptoms of COVID-19 and is seeking a medical diagnosis;

- The employee is caring for an individual subject (or advised) to quarantine or isolation;

- The employee is caring for a son or daughter whose school or place of care is closed, or childcare provider is unavailable, due to COVID-19 precautions; or

- The employee is experiencing substantially similar conditions as specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury.

Payments are capped at $511 a day ($5,110 in total) for dealing with an employee’s own illness or quarantine (reasons 1, 2 and 3 above). Employees who are caring for an individual affected by COVID-19 and those whose children's schools have closed (reasons 4, 5 and 6 above) receive up to two-thirds of their pay, and that benefit is limited to $200 a day ($2,000 in total).

As well, it is our understanding that reason 5 also applies to the regular FMLA bank. If this is not your understanding then E-SICK Tkn Child is not required below. The set up can remain the same except for the E-Sick Taken Child will not be tied to the FMLA leave policy.

Therefore, three sets of pay components and time codes will be:

- E-Sick Tkn Self – EE hrs and dollars – paid at a maximum rate of $511 per day.

- E-Sick Tkn Care – EE hrs and Dollars paid at a maximum of $200 per day.

- E-Sick Tkn Child - EE hrs and Dollars paid at a maximum of $200 per day. Reason 5 above, this bank will reduce the E-Sick bank and the regular FMLA bank.

Approach - both self and family care are eligible for the paid sick leave. Our understanding is that the daily totals would be added together to form the aggregate maximum. So if someone used 2 days to care for a family member at $200/day and the other 8 days to care for themselves at $511/day the aggregate would be $4488 ($400 + $4088).

Therefore, each employee could have their own dollar aggregate maximum. The Leave Policy will apply the aggregate maximum to the HOURS between the three categories to a maximum of 80. The rates will be capped on the individual pay components therefore the total dollar aggregate amount is unnecessary.

The leave bank must be set up to disallow over 80 hours. Therefore, any hours in the PC’s will be paid at the reduce/capped rate.

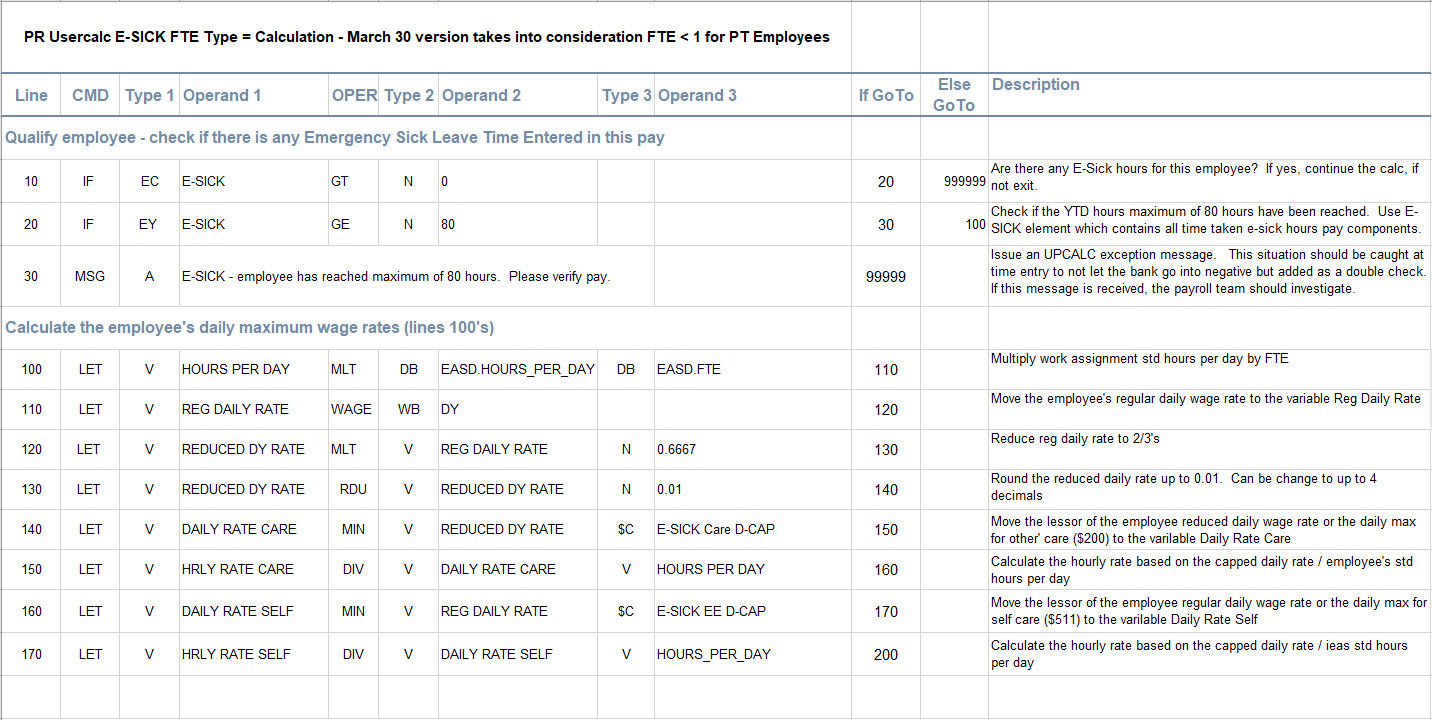

Full Time Equivalent Wages #

Question:for part-time employees, how are their standard hours per day coded on the work assignment?There are two approaches in the system:

a. Coded like full time employees with a reduced FTE.

- Example 8 hours per day is defined on their work assignment with an FTE of 0.75, full-time equivalent. The employee will be paid 6 hours per day.

- If you code the PT with the FT equivalent of 8 hours, then different logic is required to multiple their std hours by the FTE. Use the UserCalc E-SICK FTE.

- Details Available for Download (Screenshots appear later in Document) - E-SICK_FTE.xlsx

.

.

- Details Available for Download (Screenshots appear later in Document) - E-SICK_FTE.xlsx

- If you code their PT employees with the full-time equivalent of 6 hours, then use the E-SICK UserCalc.

- Details Available for Download (Screenshots appear later in Document) - E-SICK.xlsx

- Details Available for Download (Screenshots appear later in Document) - E-SICK.xlsx

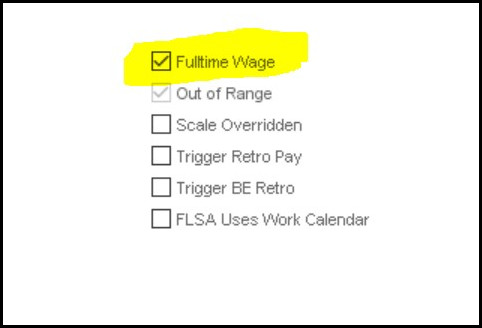

If you are unsure, select a part-time employee and go the work assignment screen (IEAS), Compensation Tab. If the Fulltime Wage toggle is turned on, then use the E-SICK FTE UserCalc.

|

SetUp #

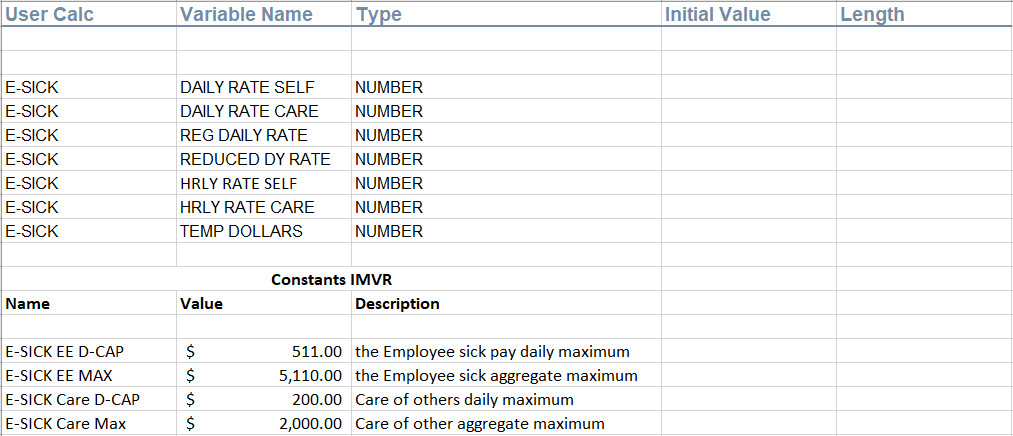

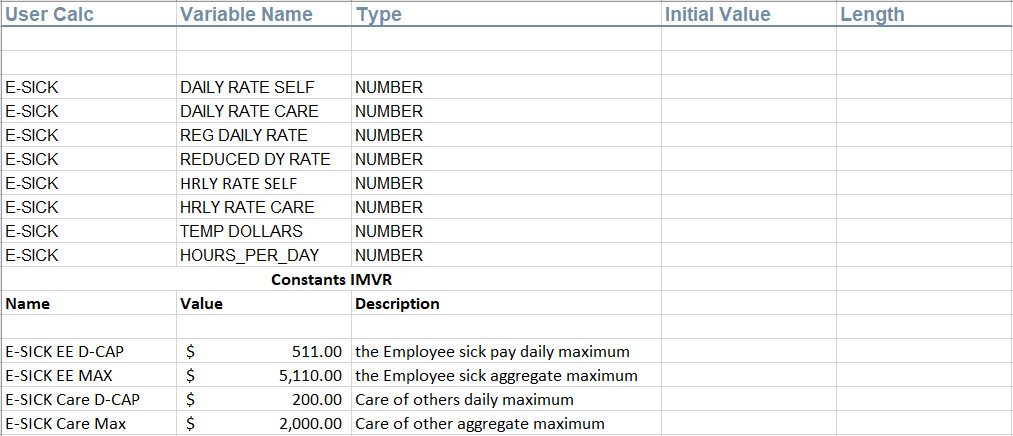

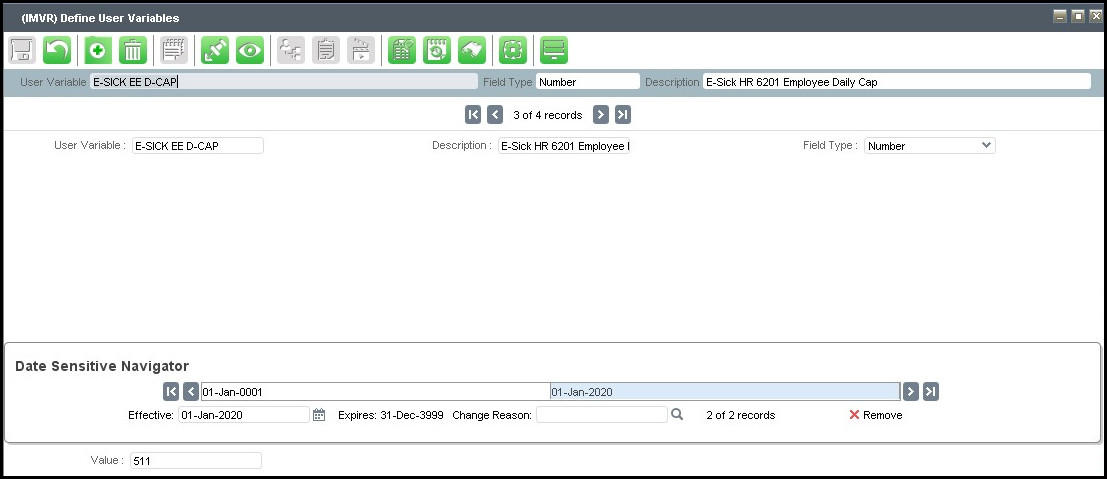

New User Variables (IMVR)#

- E-SICK EE D-CAP for the Employee e-sick pay daily maximum of $511

- E-SICK EE MAX for the Employee e-sick aggregate maximum of $5110

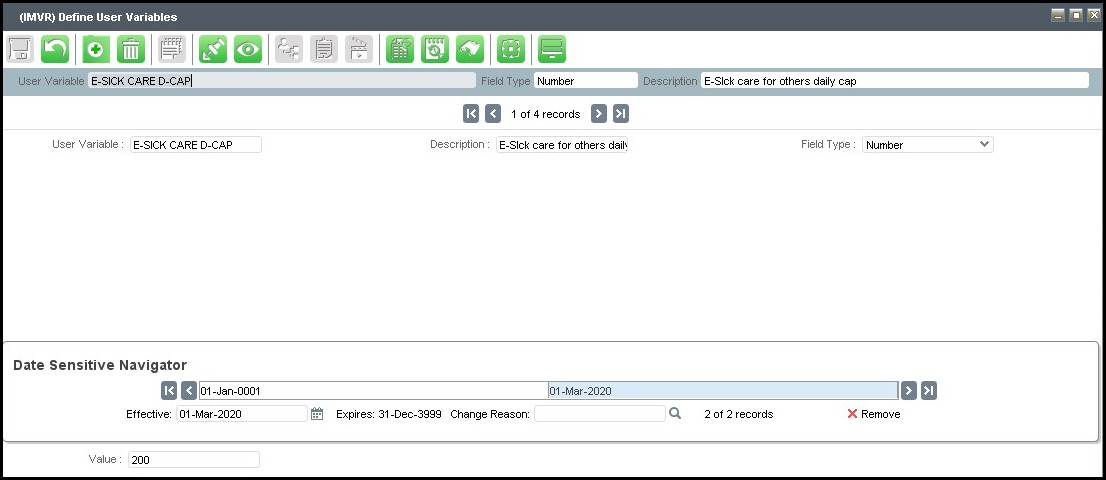

- E-SICK Care D-CAP for the care of others daily maximum of $200

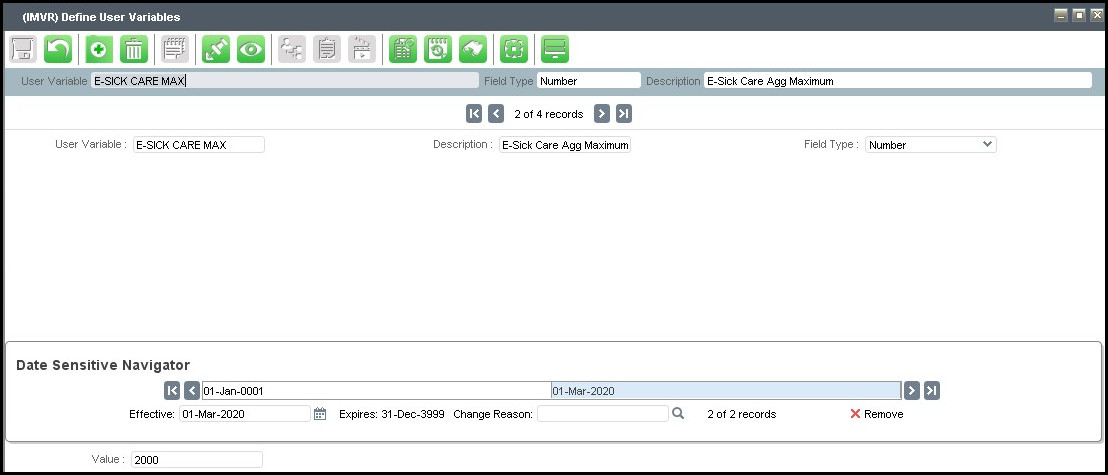

- E-SICK Care Max aggregate maximum of $2,000

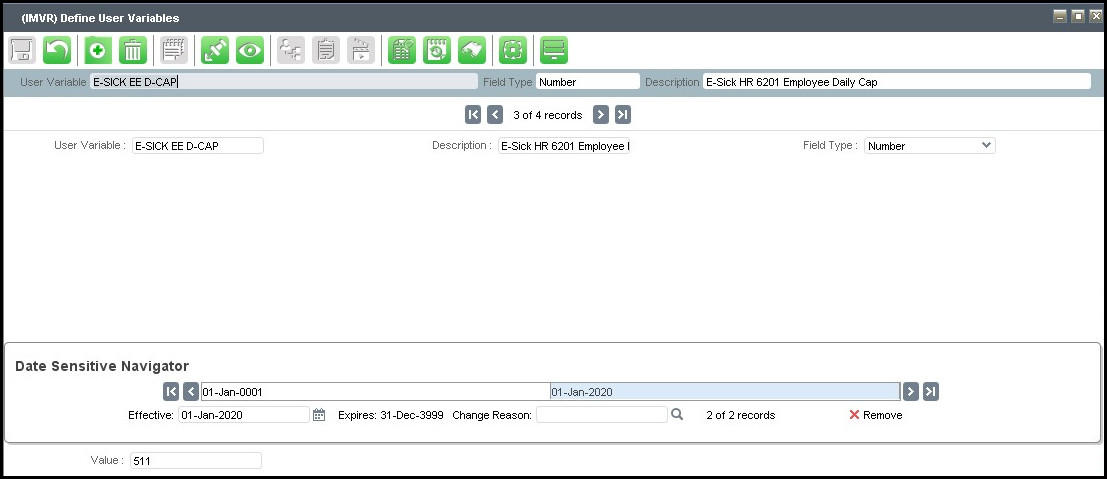

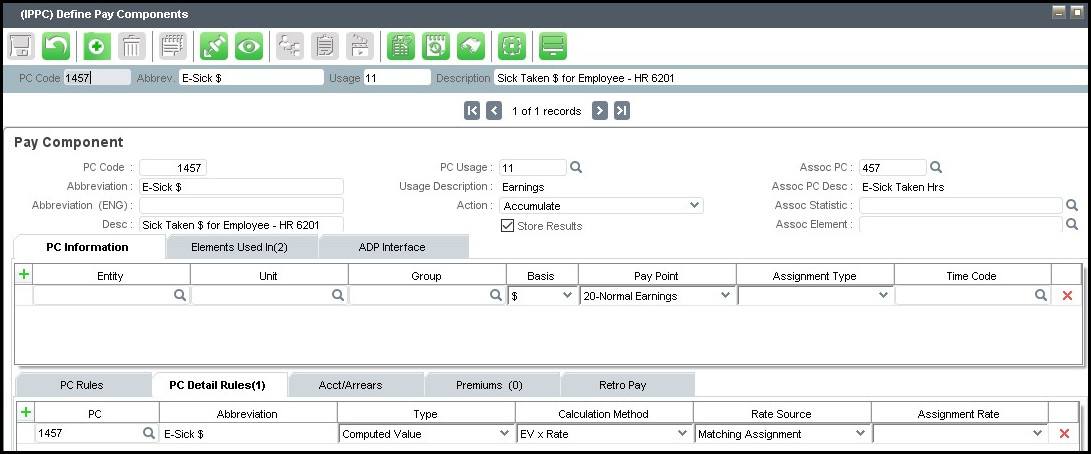

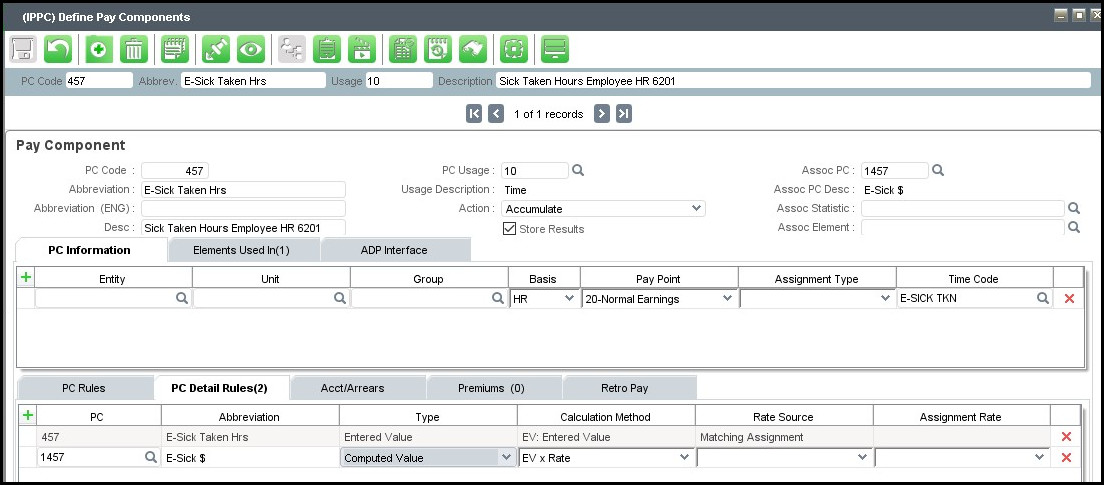

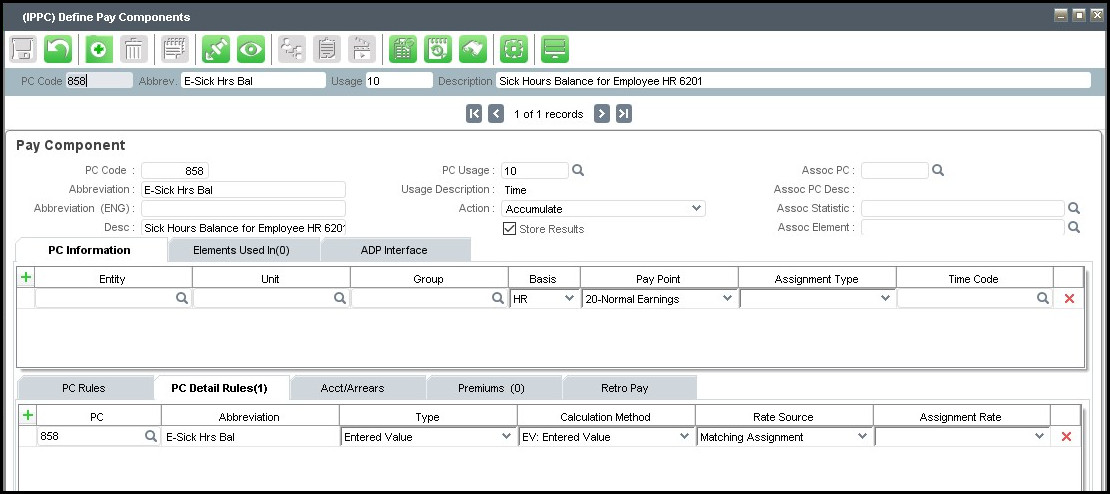

New Pay Components (IPPC) #

Clients can use their own coding and naming conventions. Be sure to change the pay components on the UserCalc to your codes.- E-Sick Taken Hrs (PC 457)

- E-Sick Taken $ (PC 1457)

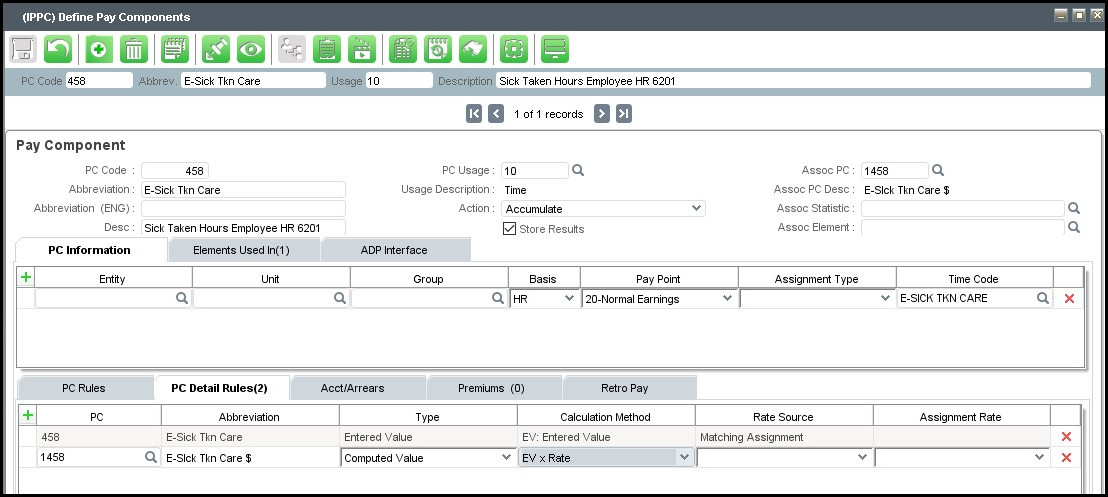

- E-Sick Taken Care (458)

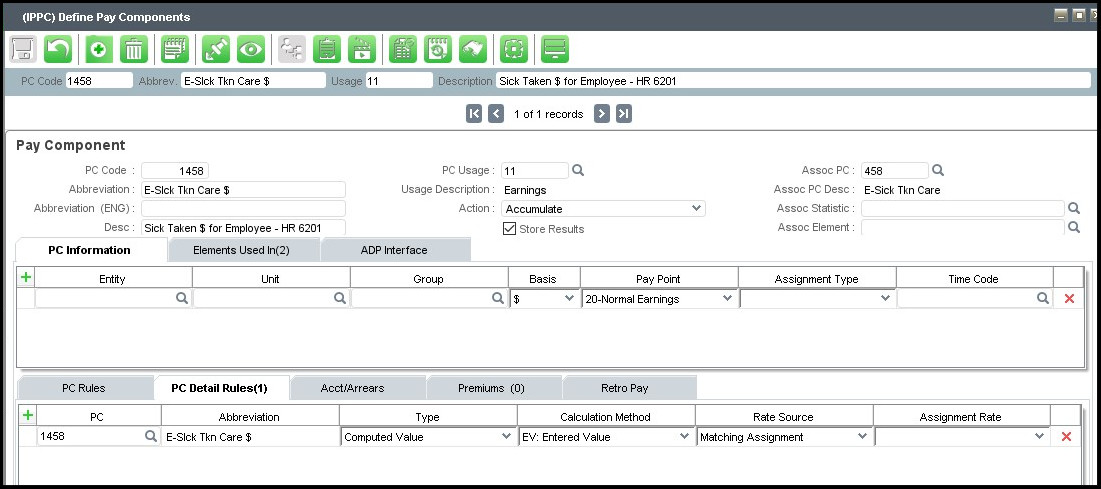

- E-Sick Tkn Care $ (1458)

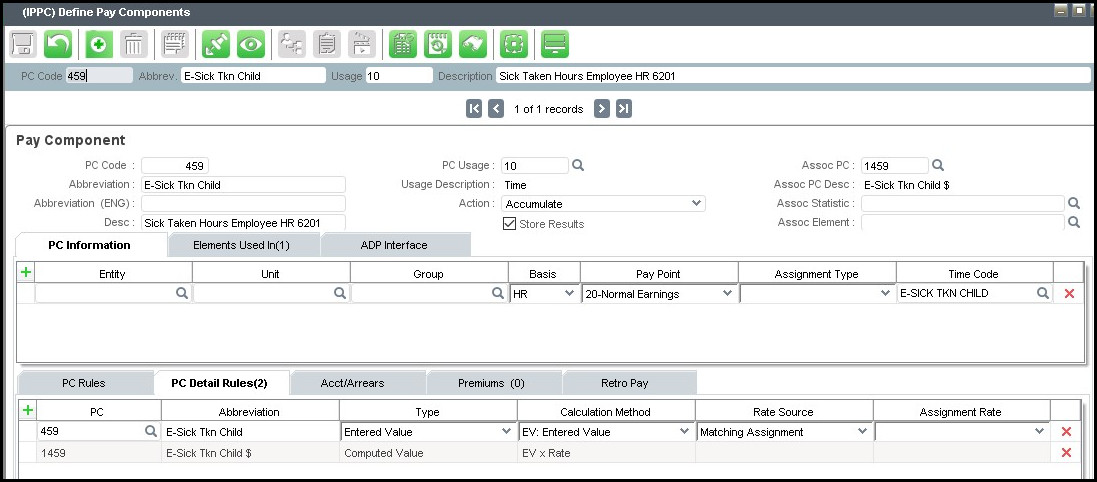

- E-Sick Tkn Child (459)

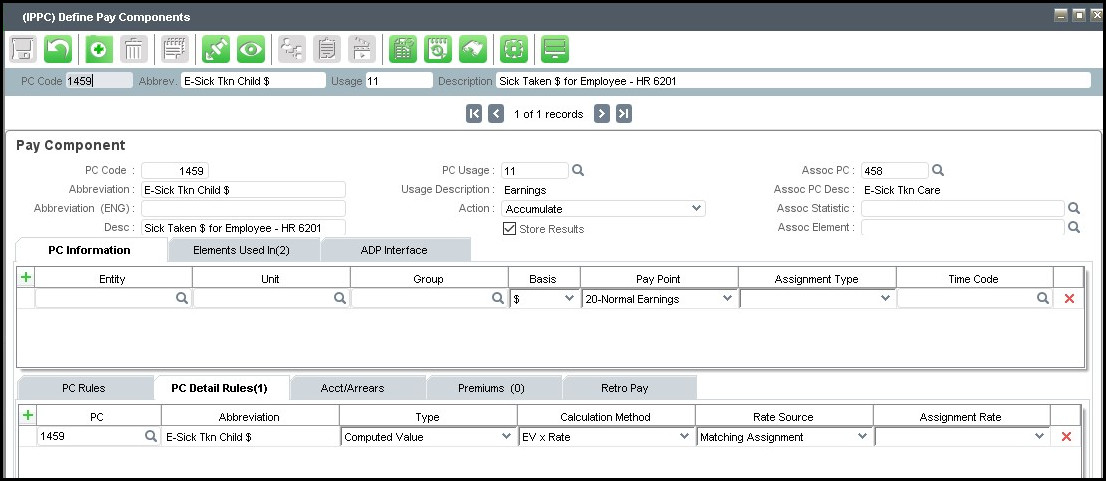

- E-Sick Tkn Child $ (1459)

Calculation Method for E-Sick Taken Hrs (PC 457) hours pay components = EV X Rate

- EV = enter value are the hours keyed.

- Rate = employee standard rate of pay

Calculation Method for E-Sick Taken Care and Child Hrs (PC 458 and 459) hours pay components = EV X Rate

- EV = enter value are the hours keyed.

- Rate = employee standard rate of pay

The daily maximum will be applied during UPCALC via the UserCalc.

Set up the properly GL coding (IDGA/IPPC)

Update all required elements.

- Hint: Run the RPPE report and search for Sick Leave Earnings.

- Be sure to update your pay stub elements to report on the employee’s pay advice.

- Do not include the earnings into FICA-ER elements as these earnings are not subject to employer portion of FICA.

New Leave Type (IAPT) #

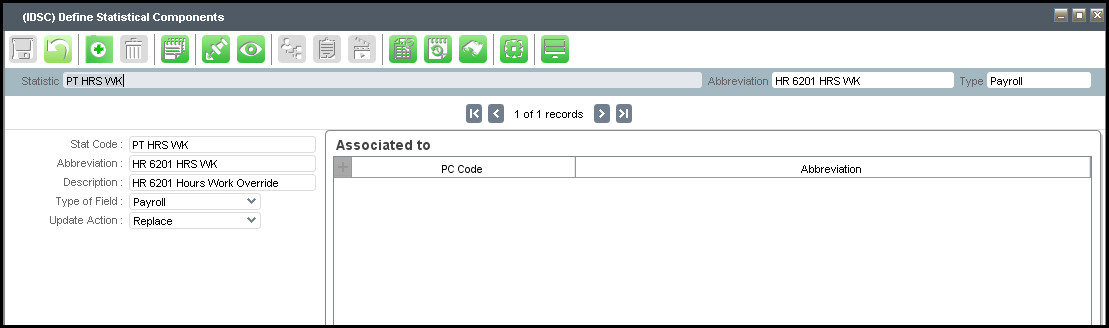

E-SICK - Minimum leave set up required to set up the payroll calculationNew Statistic Code (IDSC) #

PT HRS WK - The value in the statistic when placed on IEST will be used as the entitlement amount for the employee rather than the entitlement defined in the plan. This amount must be manually entered into IEST |

Figure 0: IDSC - PT HRS WK

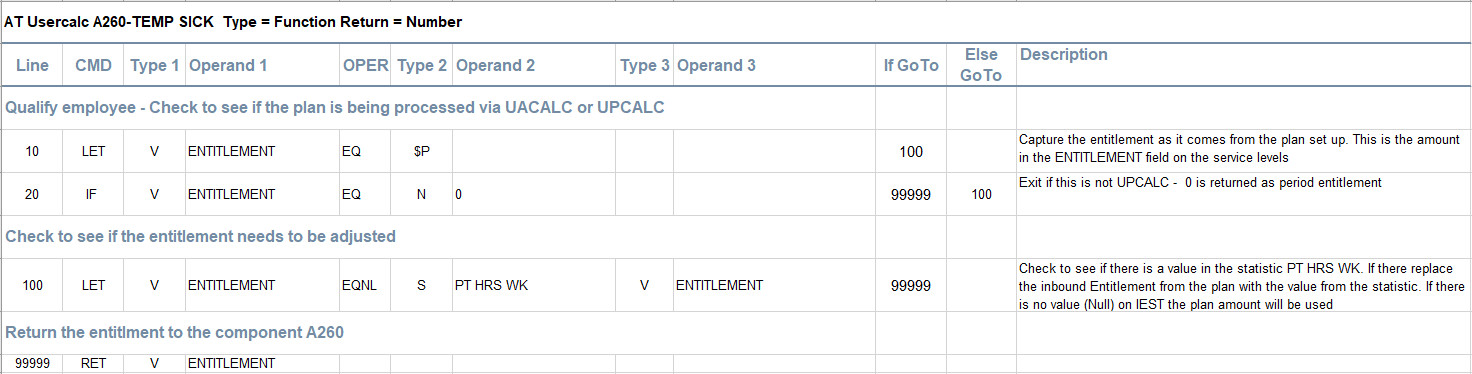

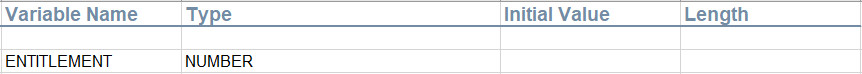

New Attendance UserCalc (IMUC) #

| User Calc Code | Purpose |

|---|---|

| A260-TEMP SICK | Allows the amount of entitlement to be overridden and replaced by the value of a statistic PT HRS WK |

|

|

New Leave Policy (IALP) #

Leave Policy Code E-SICK - linked to the New Leave Type.Policy Set Up

| Policy Start | 01-Apr-2020 | |

| Frequency | This should be calculated every pay | |

| LWOP Time Code | LWOP TAKEN (Or the name of your LWOP time Code being used) | |

| Policy Basis | HR | |

| Service Time Basis | YR | |

| Accrual Begin | Policy Date Method | |

| Time Warning Rule | Error, Do not Allow | |

| Service Level | 9999 | |

| Entitlement | 80 | |

| Entitlement Cap | 80 |

Leave Policy Components

| Seq | AC Code | Component Description | Rule | Rule Description | Value | Action | PC Code | Element | User Calc | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | A001 | Preprocess/Qualify User Calc | 00 | Use User Calc Only | - | Store on Accrual | - | - | A001-TEMP SICK | |

| 50 | A050 | Prior Year Time Adjustments | 01 | Allow Time Adjustments | - | Store on Accrual | - | - | - | |

| 100 | A100 | Service Length Calculation Method | 02 | Calculate Based on Service Date | - | Calculate | - | - | - | |

| 110 | A110 | Service Date | 02 | Use Seniority Date | - | Store on Accrual | - | - | - | |

| 120 | A120 | Service Length Evaluation Freq | 01 | Every Time Policy Evaluated (Eval Date) | - | Calculate | - | - | - | |

| 130 | A130 | Service Length | 02 | Replace Service Length | - | Store on Accrual | - | - | - | |

| 140 | A140 | Service Length Change | 01 | Amount of Service Length Change | - | Log to Leave Line | - | - | - | |

| 200 | A200 | Entitlement Frequency | 01 | Give Entitlement Each Evaluation | - | Calculate | - | - | - | |

| 260 | A260 | Period Entitlement Method | 02 | Service Level Entitlement (Prorate by FTE rule) | - | Calculate | - | - | A260-TEMP SICK | |

| 270 | A270 | Prorate by FTE Rule | 03 | Prorate by Employee FTE Value | - | Log to Leave Line | - | - | - | |

| 290 | A290 | Current Year Entitlement Time(Before Cap) | 01 | Increment Time Entitlement | - | Log and Accrue | - | - | - | |

| 300 | A300 | Total Time Taken | 01 | Derive from All Sources | - | Store on Accrual | 9955 | - | - | |

| 320 | A320 | Time Available to Take Before Caps | 02 | Prior Year Plus Current Year less Taken | - | Store on Accrual | - | - | - | |

| 330 | A330 | Current Year Entitlement(Caps Applied) | 02 | Total Entitlement Limit(Use Annual Entitle Cap) | - | Store on Accrual | - | - | - | |

| 703 | A700 | Current Year Time Available | 02 | Prior Plus Current Year less Taken | - | Log and Accrue | 858 | - | - | |

| 1400 | A1400 | Default Time Code/Pay Component for Leave Entry | 01 | Pay Component | - | Calculate | 457 | - | - |

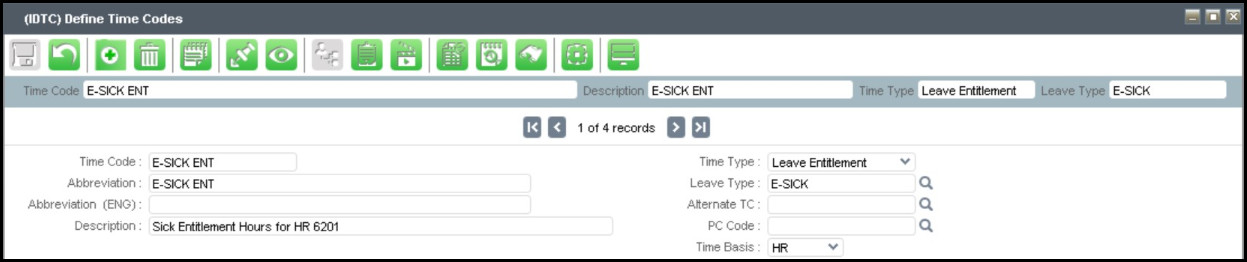

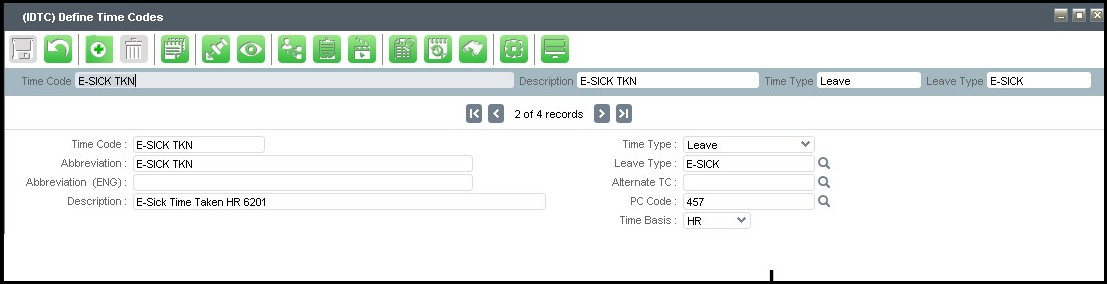

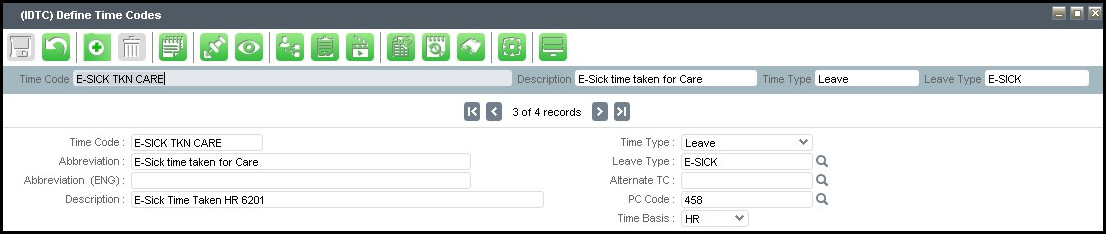

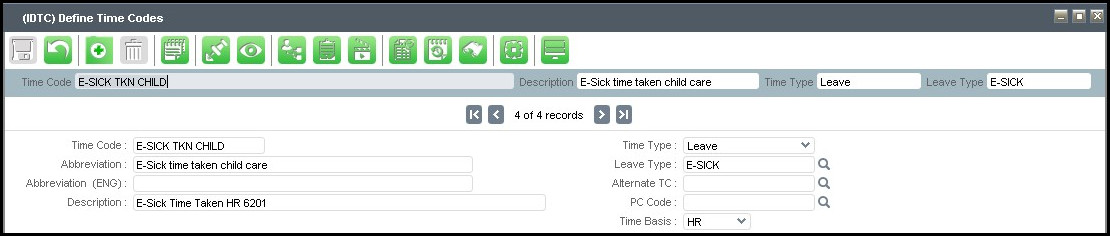

New Time Codes (IDTC) #

- E-Sick Ent – Type of Leave Entitlement, tied back to PC 857

- E-Sick Tkn – Type of Leave, tied back to PC 457,leave type = E-Sick

- E-Sick Tkn Care - Type of Leave, tied back to PC 458, leave type = E-Sick

- E-Sick Tkn Child - Type of Leave, tied back to PC 459, leave type = E-Sick

Once the time codes are entered, go back to the pay components and update the associated time codes.

Add the time codes to the Work Rules as authorized time codes.

Add a new element E-SICK (used in the UserCalc – IPPE)

- Add the hours taken pay components.

- E-Sick Taken Hrs (PC 457)

- E-Sick Taken Care (458)

- E-Sick Taken Child (459)

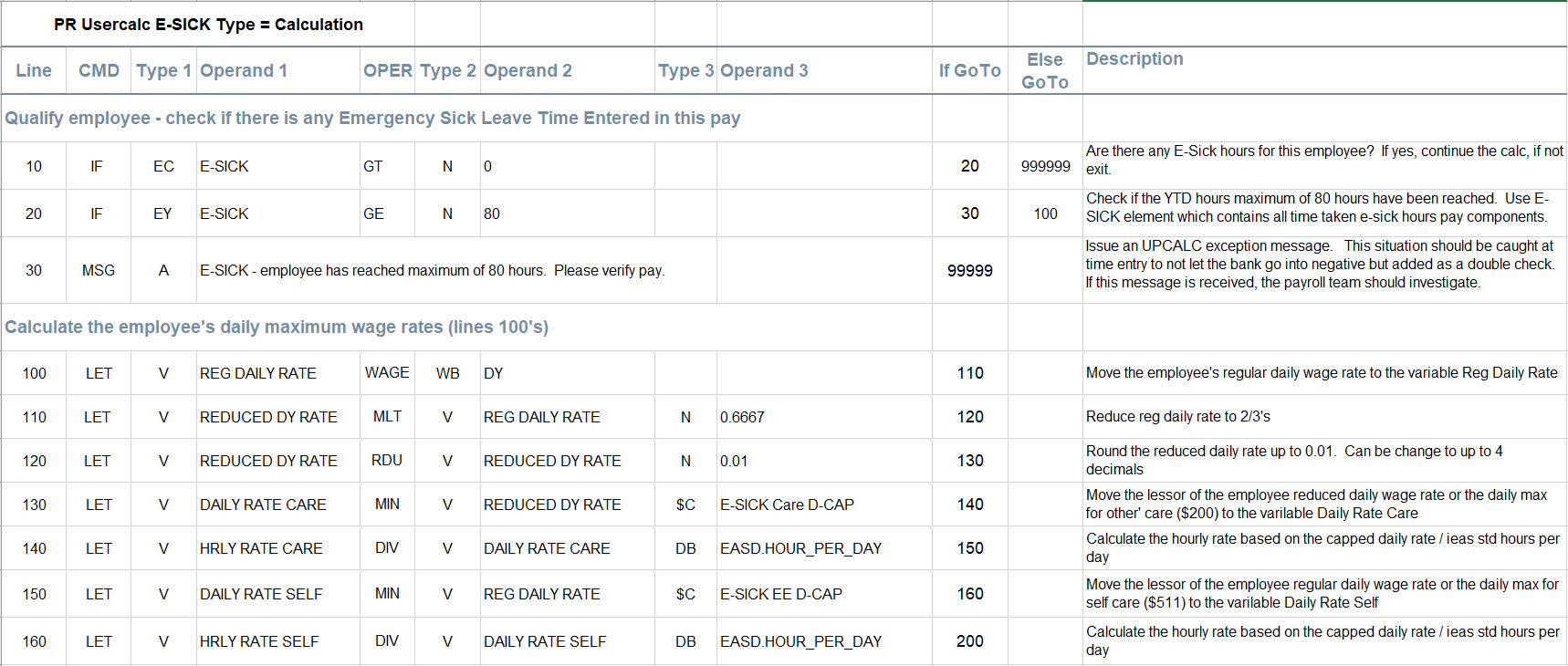

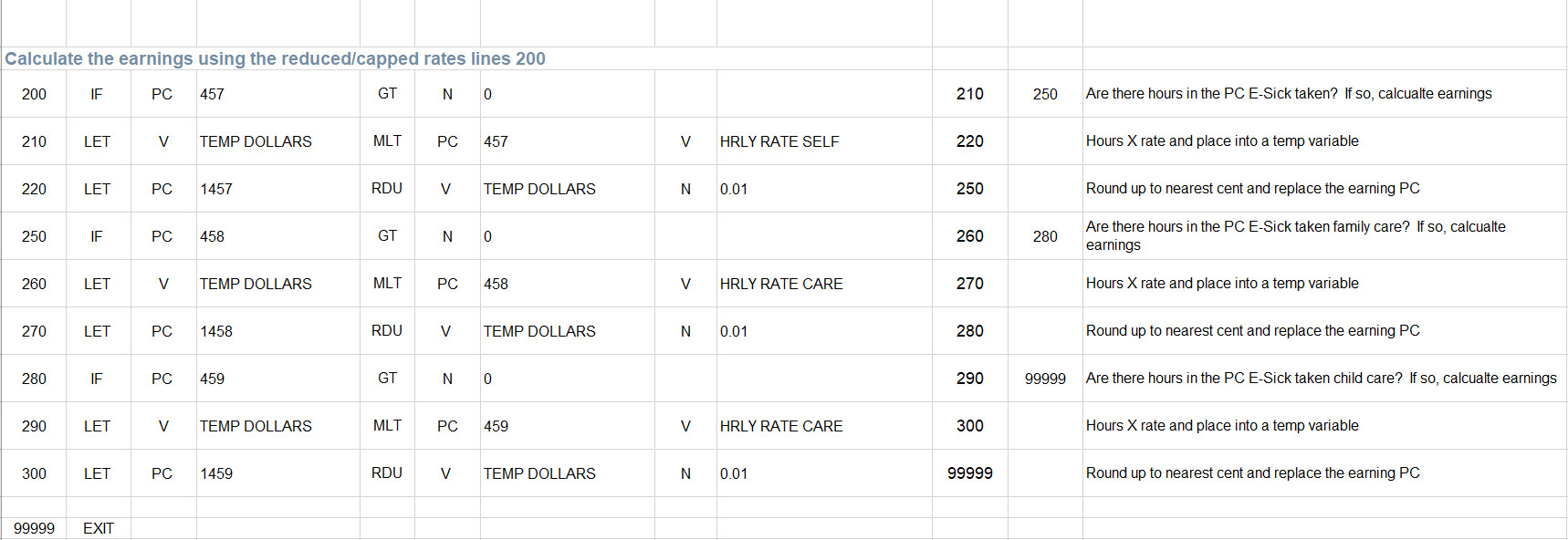

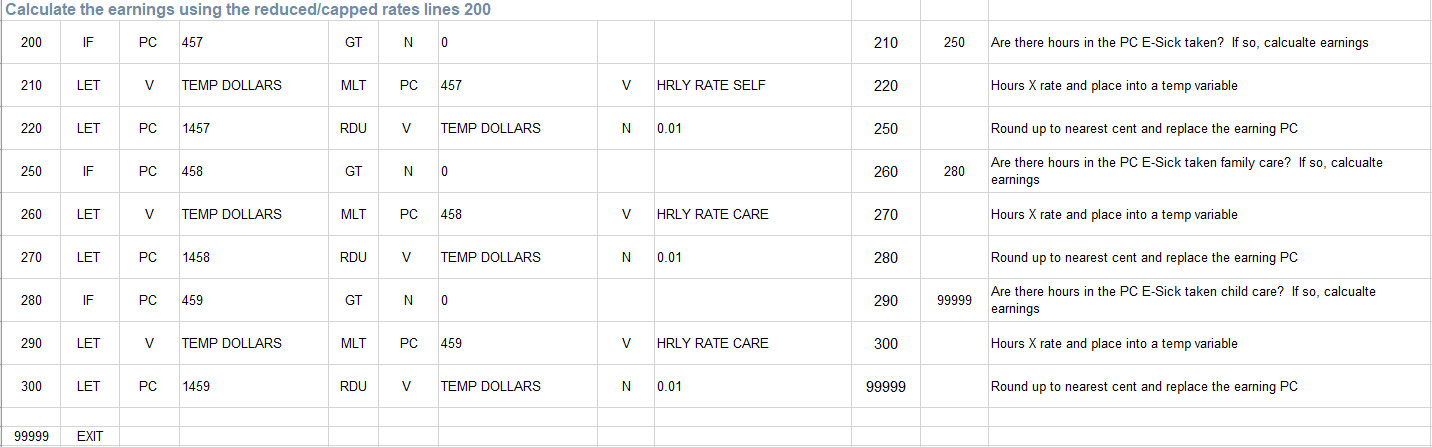

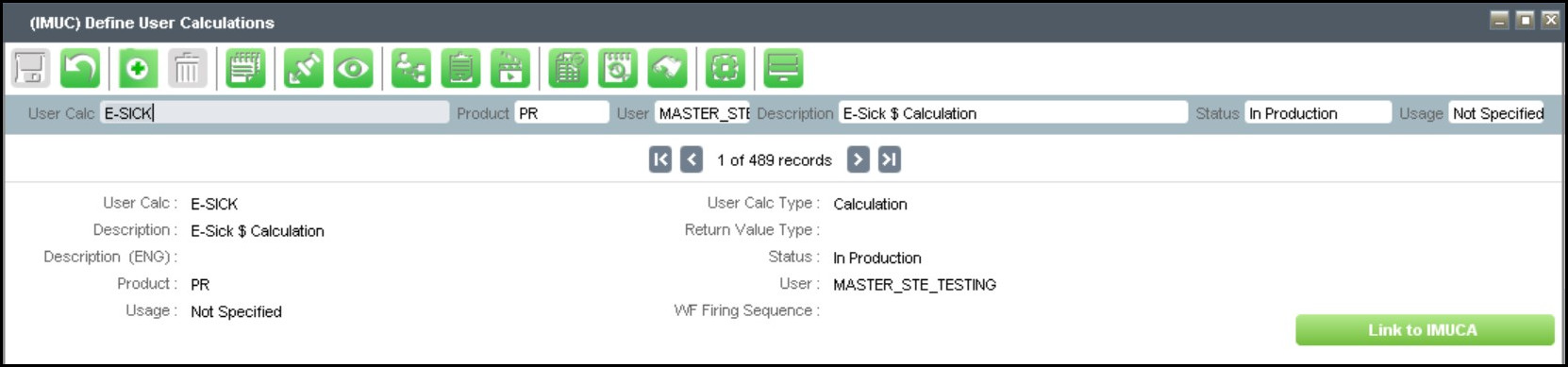

New payroll UserCalc (IMUC) #

UserCalc named E-SICK or E-SICK FTEE-Sick UserCalc

|

|

|

E-Sick FTE UserCalc

|

|

|

- Applies the daily maximums rates and the program maximums.

- Recalculates the earnings based on the capped rate.

- A Payroll UserCalc is required as there are no PC’s rules apply this type of maximum.

- Before adding the UserCalc lines, please set up the UserCalc variables (E-SICK Variables tab in the spreadsheet)

- Qualification – UserCa

- Only execute the UserCalc if the employee has e-sick hours by checking the E-SICK element for a value.

- The second qualification really should not be required. Check the YTD hours taken (E-SICK element) is greater/equal to 80 then issue a message and exit.

- The time entry should capture the LWOP once the employee exceeds their 80 hour entitlement.

- Calculate the two capped and daily rates (lines 100)

- Move the employee’s regular work assignment daily rate to variable REG DAILY RATE

- Move the lessor of the reduce daily rate or $200 into variable DAILY RATE CARE

- Move the lessor of the daily rate or $511 into variable DAILY RATE CARE

- Calculate the employee’s aggregate maximum

- This section is not required since the time entry will cap at 80 hours

- At this point in the UserCalc, we have the current rates capped/reduced to be paid to the employee. Calculate the earnings and populate the earnings PC’s.

- Multiple HRLY RATE SELF X number of hours in PC 457 and replace PC 1457

- Multiple HRLY RATE CARE X number of hours in PC 458 and replace PC 1458

- Multiple HRLY RATE CARE X number of hours in PC 459 and replace PC 1459

- Qualification – UserCa

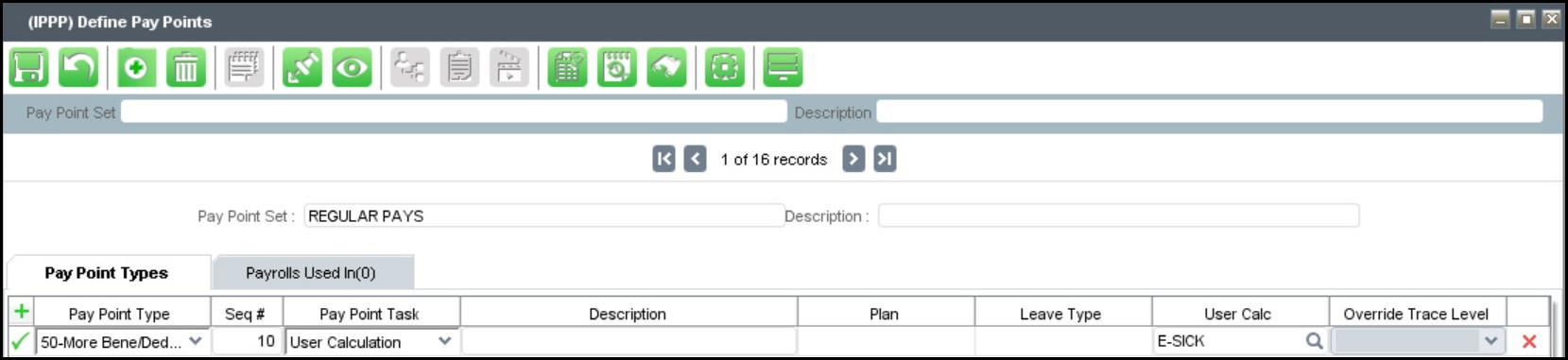

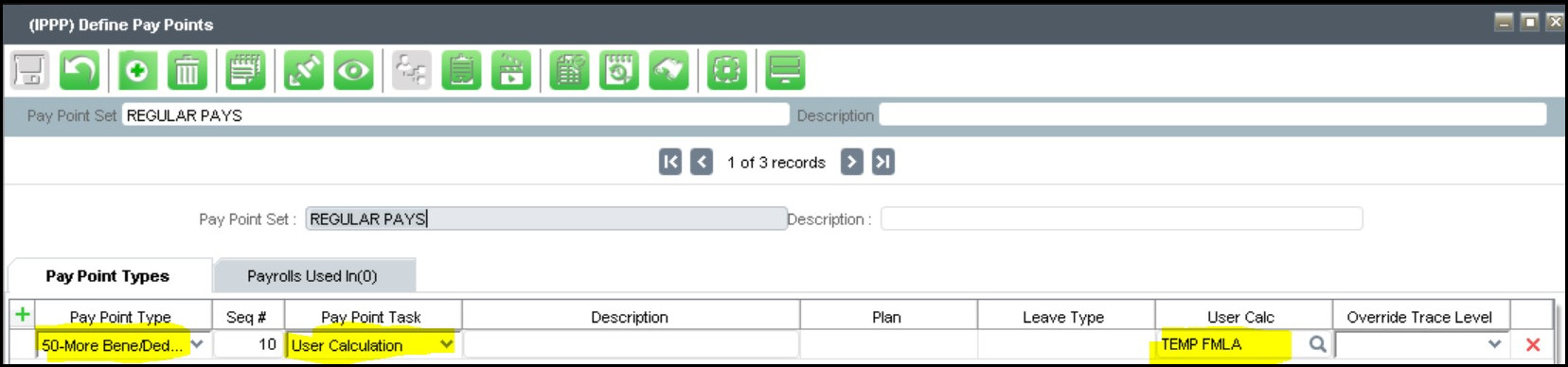

Update Pay Point (IPPP)#

- Add the UserCalc to your Pay Point sets.

- The example below shows Pay Point Type of 50 on the Regular Pay set. It can be at any Type before legislative tax calculation.

- Be sure to add it to each required Pay Point Set.

UPCALC Exception Messages #

“E-SICK - employee has reached maximum of 80 hours. Please verify pay”.

Action Required – the employee should never have 80 hours in pay history with current hours in the payroll.

Investigation required on how time was entered for E-Sick.

Sample Configuration: #

Please note this is not the complete set up required. For example, the Pay Component GL (Acct/Arrears tab) needs to be configured but is not included in these samples.

STEP 1: User Variables (IMVR) set up the User Variables

|

Figure 2: IMVR Cared Cap Variable

|

Figure 3: IMVR Care Max

|

Figure 4: IMVR Sick EED-Cap

|

Figure 5: IMVR EE Max

STEP 2: Pay Components (IPPC)

7 PCs required in set up

Hint: Set up the Earnings PCs first as they are required for the Hours PCs

|

Figure 6: E-Sick $ Pay Component

|

Figure 7: E-Sick Taken Hours Pay Component

|

Figure 8: E-Sick Taken Care $ Pay Component

|

Figure 9: E-Sick Taken Care Hours Pay Component

|

Figure 10: E-Sick Taken Child $ Pay Component

|

Figure 11: E-Sick Taken Child Hours Pay Component

|

Figure 12: E-Sick Hours Balance Pay Code

STEP 3: Leave Policy (IAPT)

Use the next available leave policy type. It does not have to be 182 as shown below.

|

Figure 13: Define Leave Policy Type

STEP 4: Time Codes (IDTC)

|

Figure 14: E-Sick Entitlement

|

Figure 15: E-Sick Taken

|

Figure 16: E-Sick Taken Care

|

Figure 17: E-Sick Taken Child

STEP 5: Set up the UserCalc (IMUC)

Please see E-Sick Usercalc on top of the form for details

|

Figure 18: E-Sick UserCalc on IMUC

STEP 6: Pay Point IPPP

|

Figure 19: Pay Point Type

STEP 7: Pay Point IPPP

|

Figure 20: Pay Point Type

You have now completed the setup of Emergency Sick Leave