GENERATE FLSA ON PRIOR BONUS EARNINGS#

Overview#

When ever bonuses are paid to employees for prior period earnings, Fair Labor Standards Act FLSA calculations are affected when any overtime hours were worked within the prior period. In normal situations, these earnings would be dated appropriately in the prior period and FLSA would be automatically invoked during the calculation of the employee pay. If that is the case, then this process is not required and the normal pay cycle will handle the reassessment of FLSA.

If however these bonuses are considered part of the employee’s base wage, then the normal FLSA reassessment will not work since it would only use the employee wage as of the prior period. UPFLSABONUS adjusts the ‘Rate of Pay’ by the value of the bonus and then recalculates FLSA earnings to be paid in the prior ‘Bonus Period’.

The calculations used by this process are actually completely separate from the normal FLSA process and they do not cooperate with each other. It is important not to confuse the two since each considers the employee salary/compensation differently.

There can be any number of different bonus periods; some examples are Monthly, Quarterly and Annual. Educational institutions will often have a ‘Semester’ or ‘Term’ bonus as well.

Calendar Definition#

Each different bonus period (Monthly, Quarterly, Yearly etc) will require a unique calendar to be set up in order to define that bonus period. The calendar is defined in function Define Business Calendars (IDCL) form. A calendar can be of any duration and is restricted ONLY in that it must be contiguous from the first entry through to the last entry.

Any of these calendars can easily be extended when needed by the Extend Calendar button in IDCL.

Element Definition #

The formula/calculation used by UPFLSABONUS requires that certain elements be set up in IPPE to calculate the total value for hours and earnings in a bonus period. These are all required and UPFLSABONUS will terminate prematurely if any are missing.- An element is required for ‘Regular Hours’. These are any ‘Worked Hours’ that are paid at a regular rate of pay.

- An element is required for ‘Overtime Hours’. These are any ‘Worked Hours’ that are paid at 1.5 times the regular rate of pay.

- An element is required for ‘Double time Hours’. These are any ‘Worked Hours’ that are paid at 2 times the regular rate of pay.

FLSA Pay Component Definition#

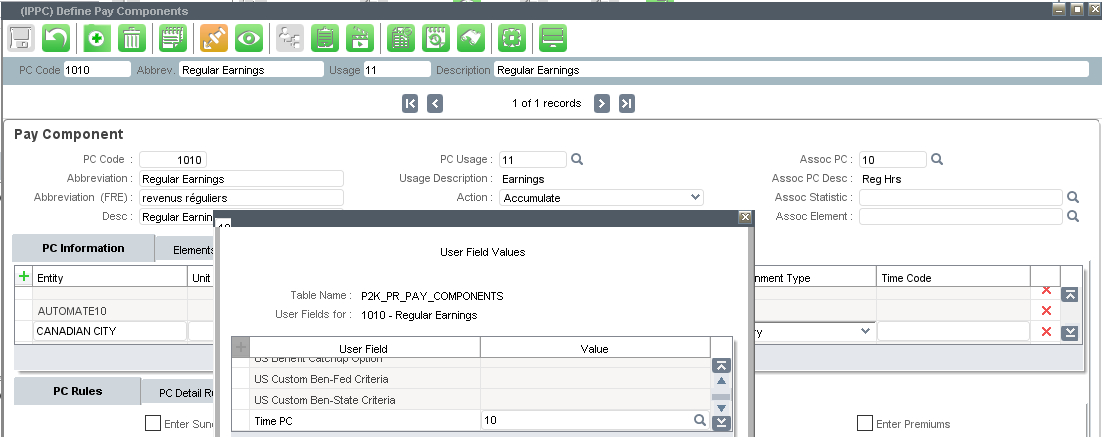

One Earnings pay component must be set up in order to record any calculated FLSA on the prior period earnings. Although there can be multiple ‘Bonus Periods’, only one ‘FLSA Earnings’ pay component should be setup. When recording any FLSA Earnings into this component, any values previously given earngings are taken into consideration so that the FLSA is not overpaid.This pay component should be defined as shown below. Be sure to toggle the pay component as ‘Store Results’.

Bonus Pay Components#

For each different bonus period, a separate pay component must be set up for the actual bonus earnings. This pay component is used to record the actual bonus earnings for each employee when the bonus pay is entered before running UPFLSABONUS.Separate pay components for each type are necessary to keep the bonus earnings separated for each type of bonus period.

The Calculations#

For the bonus batch selected, the pay is evaluated for the bonus period to determine if any additional FLSA earnings need to be recorded.Each of the pays with a ‘Pay Issue Date’ within the bonus period is evaluated separately.

The formula used on each pay is exactly as shown below. Dates and values have been plugged in to better illustrate the calculations.

Bonus earnings in the batch must be dated on the last day of the bonus period.

| (A) | Hourly Rate of Pay on 11-May-2007 ==> $41.03/HR |

| (B) | Quarterly Incentive from 01-Jan-2007 to 31-Mar-2007 ==> $1,000.00 |

| (C) | Regular Hours from 01-Jan-2007 to 31-Mar-2007 ==> 144.00 |

| (D) | Overtime Hours from 01-Jan-2007 to 31-Mar-2007 ==> 7.00 |

| (E) | Double time Hours from 01-Jan-2007 to 31-Mar-2007 ==> 7.00 |

| (F) | Quarterly Regular Earnings: $5,907.69 = (A) $41.03 X (C) $144.00 |

| (G) | Quarterly Regular Plus Incentive: $6,907.69 = (B) $1,000.00 + (F) $5,907.69 |

| (H) | Quarterly Adjusted Rate: $47.97 = (G) $6,907.69 / (C) $144.00 |

| (I) | Quarterly Hourly Rate Increment: $6.94 = (H) $47.97 - (A) $41.03 |

| (J) | Quarterly Overtime FLSA: $72.92 = (I) $6.94 * (D) $7.00 * 1.5 |

| (K) | Quarterly Overtime FLSA: $97.22 = (I) $6.94 * (D) $7.00 * 2.0 |

| (L) | Quarterly FLSA Total: $170.14 = (J) $72.92 + (K) $97.22 * 2.0 |

| (M) | Quarterly FLSA Previously Paid: $0.00 |

| (N) | Quarterly FLSA Retroactive Added: $170.14 |

The FLSA earnings (N) are logged into the same batch as the bonus earnings. This batch is provided as a report parameter.

When any FLSA is recorded, the bonus pay (as well as the batch) is marked as ‘To Be Audited’. UPAUDT must be executed before the Bonus Batch of Incentive Earnings and FLSA Earnings (added here) can be paid to the employee.

Report Parameters#

Each type of bonus period is processed separately. For example, the ‘Monthly’ bonus is executed separately from the ‘Term Bonus’. Be careful to select the correct ‘Bonus Pay Component’ for the type of bonus.The single batch number selected contains the bonus earnings for each employee paid a bonus. There can be more than one bonus batch, however, they are processed separately.

| Report Parameters | |

|---|---|

| Entity | Mandatory,LOV available This field lets you identify the entity associated with the report. |

| Payroll | Mandatory,LOV available This field lets you identify the payroll associated with the report. |

| Bonus Batch Number | Mandatory,LOV available This field lets you identify the bonus batch number associated with the report. |

| Bonus Calendar | Mandatory,LOV available This field lets you identify the bonus calendar associated with the report. |

| Bonus Period | Mandatory,LOV available This field lets you identify the bonus period associated with the report. |

| Trial | Optional, Yes or No lexicon available//You may choose to run the report in a trial mode to see results <Yes> or in update mode <No>. |

| Exception Level | Mandatory, Exception Level lexicon available This field defines the exception level (report messages) required. |

| User Comments | Optional, Text This field holds the user-supplied comment which will appear in the header of all pages of the report. This is useful during testing phases to identify similar reports from each other. |

| Definition (Static Information) | |

|---|---|

| Bonus Pay Component | Mandatory,LOV available This field lets you identify the bonus pay associated with the report. |

| FLSA Pay Component | Mandatory,LOV available This field lets you identify the FLSA pay component associated with the report. |

| Regular Hours | Mandatory,LOV available This field lets you identify the regular hours associated with the report. |

| Overtime Hours | Mandatory,LOV available This field lets you identify the overtime hours associated with the report. |

| Double Time Hours | Mandatory,LOV available This field lets you identify the double time hours associated with the report. |