FMLA ACCRUAL RULE (One Year Prev)#

The One Year previous rule is a rule that looks back 365 days prior to the leave line being evaluated to check the amount available for the employee to take in the current period. The accrual end date is the end of the pay period being evaluated and the accrual start date is 365 days prior to the end date. The system will look at all leave lines taken in the 365 day period and check to see what the hours are compared to the accrual defined in the Service levels tab if there is time available the employee will be able to take the time otherwise it will go to LWOP.

Biweekly Example:#

An employee uses FMLA leave multiple times during the year. The accrual is always 480 hours however as time is used the bank balance is reduced until it has been a year since the original time was taken. At that point the time used in that time frame is added back to the bank to be available to the employee again. This creates a constant rolling balance within the bank of the original 480 hours, time taken and time added back after 365 days has elapsed. If the employee has gone an entire year without FMLA being taken the bank would end up with 480 hours again available for use.| Start Date | End Date | Accrual | Time Added Back | Time Taken | Balance |

| 15-Jun-2013 | 14-Jun-2014 | 480 | 80 | 400 | |

| 29-Jun-2014 | 28-Jun-2014 | 80 | 320 | ||

| 13-Jul-2014 | 14-Jul-2014 | 20 | 300 | ||

| 27-Jul-2014 | 26-Jul-2014 | 300 | |||

| 10-Aug-2014 | 09-Aug-2014 | 300 | |||

| 24-Aug-2014 | 23-Aug-2014 | 300 | |||

| 07-Sep-2014 | 06-Sep-2014 | 300 | |||

| 21-Sep-2014 | 20-Sep-2014 | 40 | 260 | ||

| 05-Oct-2014 | 04-Oct-2014 | 40 | 220 | ||

| 19-Oct-2014 | 18-Oct-2014 | 40 | 180 | ||

| 02-Nov-2014 | 01-Nov-2014 | 180 | |||

| 30-Nov-2014 | 29-Nov-2014 | 180 | |||

| 14-Dec-2014 | 13-Dec-2014 | 180 | |||

| 28-Dec-2014 | 27-Dec-2015 | 180 | |||

| 11-Jan-2015 | 10-Jan-2016 | 180 | |||

| 25-Jan-2015 | 24-Jan-2016 | 180 | |||

| 08-Feb-2015 | 07-Feb-2016 | 180 | |||

| 22-Feb-2015 | 21-Feb-2016 | 180 | |||

| 22-Mar-2015 | 21-Mar-2016 | 180 | |||

| 05-Apr-2015 | 04-Apr-2016 | 180 | |||

| 19-Apr-2015 | 18-Apr-2016 | 180 | |||

| 03-May-2015 | 02-May-2016 | 180 | |||

| 17-May-2015 | 16-May-2016 | 180 | |||

| 31-May-2015 | 30-May-2016 | 180 | |||

| 14-Jun-2015 | 13-Jun-2016 | 180 | |||

| 28-Jun-2015 | 27-Jun-2016 | 80 | 180 | ||

| 12-Jul-2015 | 11-Jul-2016 | 80 | 180 | ||

| 26-Jul-2015 | 25-Jul-2016 | 20 | 360 | ||

| 09-Aug-2015 | 08-Aug-2016 | 360 | |||

| 23-Aug-2015 | 22-Aug-2016 | 360 |

The Entitlement for the 365 days period will be retrieved from the ‘Entitlement Time’ column in the ‘Service Level’ associated with the Leave Policy.

IALA (Accrual Record)#

User procedures are first defined on the Maintain Functions (IMFN) screen.

- A new start and end date is created for the policy each time UACALC or UPCALC is run for the policy

- The entitlement is calculated each time UACALC or UPCALC is run

- Year end processing doesn’t take place with this bank as the bank rolls every pay period or UACALC processing date, therefore no A900 rule is required

- If running from UPCALC the accrual end date will be obtained from the pay period end date

- If running from UACALC the AS OF DATE of processing will be used as the end date

- The date on the accrual in not significant as the time available to take is calculated each time a leave line is entered

- The entitlement will be updated each time UPCALC or UACALC is run so if FTE rules are being used to obtain the entitlement, it will be updated accordingly.

- FMLA requires the employee to be employed for one year and to have worked 1250 hours each year to qualify. With this rule, the 1250 hours is also a ‘rolling year’. Additional functionality using User Calc operators will be used to handle this requirement. (See example of a sample User Calc shown later in this document)

User Defined Field#

A User Defined Field is created the first time this rule is used. This User Defined Field will be on the leave line created for policies using this specific rule. The text in the User Defined Field will display how the time taken for the prior 365 days has been calculated. It will also give the entitlement owed the employee before the current entry. You can add the UDF to the Requested Tab of the IAAL using the IMFDH. |

SET UP Requirements:#

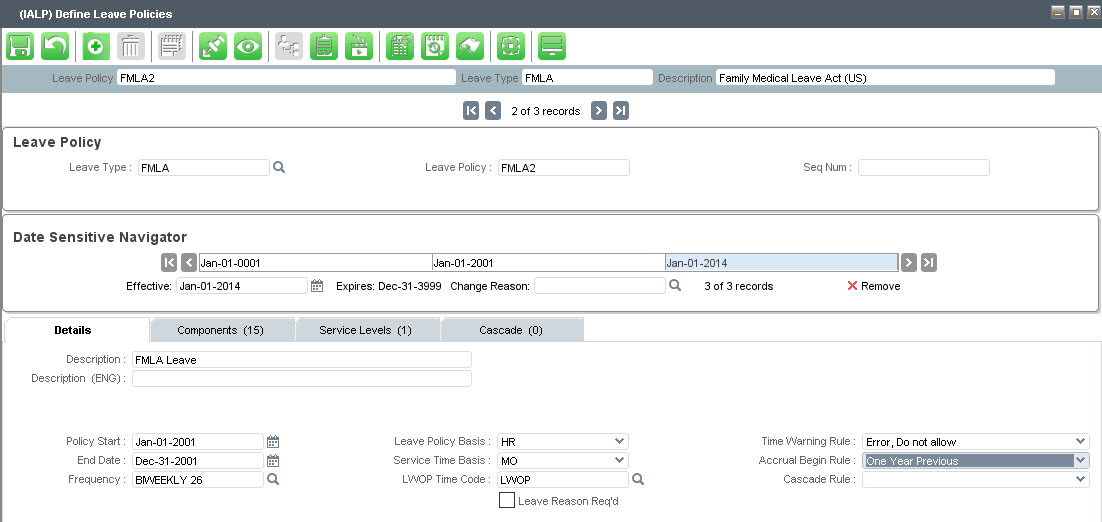

IALP – Leave Policy#

Details Tab:#

Accrual Begin Rule: One Year Previous End Date: Null Frequency: Null |

Components:#

NOTE: A200 Rule must be ‘01’ A290 Rule must be ‘02’ (see defect 40149), prior to this defect the rule was ‘01’| AC Code | Seq | Rule | Required | Compenent Description | Rule Description |

| A001 | 1 | 00 | Preprocess/Qualify Usercalc | Use User Calc Only | |

| A100 | 100 | 02 | R | Service Length Calculation | Calculate Based on Service Date |

| A110 | 110 | 02 | R | Service Date | Hire Date |

| A120 | 120 | 01 | R | Service Length Evaluation Freq | Every Time Policy Evaluated (Eval Date) |

| A130 | 130 | 02 | R | Service Length | Replace Service Length |

| A140 | 140 | 01 | R | Service Length Change | Amount of Service Length Change |

| A200 | 200 | 01 | R | Entitlement Frequency | Give Entitlement Each Evaluation |

| A260 | 260 | 02 | R | Period Entitlement Method | Service Level Entitlement (Prorate by FTE) |

| A270 | 270 | 03 | Prorate by FTE Rule | Prorated by EE’s FTE value | |

| A290 | 290 | 02 | R | Current Year Entitlement | Rederive Time Entitlement |

| A300 | 300 | 01 | R | Total Time Taken | Derive from All Sources |

| A320 | 320 | 03 | R | Time Available to Take | Prior Year Plus Annual Entitlement Cap |

| A330 | 330 | 03 | R | Current Year Entitlement | Entitlement with No Caps Applied |

| A700 | 703 | 02 | R | Current Year Time Owing | Prior Plus Current Year Less Taken |

| A900 | 300 | 03 | Time Owing at Year End | Cap Current Owing with Year-end Cap (YE Cap is zero) |

IMUC#

A User Calculation to verify the hours worked for the employee in the past 12 months may be added at A260 to prevent entitlement if needed. A sample User Calculation is below. This User Calculation verifies hours worked in the last 12 months. If the employee has worked at least 1250 hours the normal number parameter will be passed through at this point. If the employee has worked less than the 1250 hours, the parameter will be reset to ‘0’.The ELPL Usercalc operator has been enhanced to provide the ability to use any date range when computing the value for an Element from Pay Transactions. Previously this feature always used the Pay Period Start Date as the begin date and ‘Operator 3’ as the end date.

There are two ‘Variables’ that can be used to control the begin and end dates when using the ELPL operator. If either or both of these variables exist in the Usercalc, then the value loaded into them will be used by the ELPL Operator. NOTE: This will look at all pay headers associated with the employee’s assignments within the current employment. The Usercalc will look at the pay lines for the dates, and the pay details for the amounts.

If the variables identified above are NOT in the Usercalc, then the ELPL Operator will work the same way it has in the past.

The names of the two variables must be ‘Exactly’ as shown in this example:

|

IPPP#

The attendance type must be added to the appropriate pay points. If the FMLA time codes will be associated to other leave policies, ensure that FMLA is listed on the pay point before the other policies.IALS#

The time codes used for this policy type must be added to the leave schedule.IALA#

See example below where the ‘unofficial’ accrual has updated start and end dates. |

High Line Recommendations for converting historical FMLA data into IAAL:#

The following steps should be used when converting leave lines:1. Load transactions to the IPTL (via LMTD) with a destination of IPTR. The following information must be provided:

- Employee Information (i.e. Person Code)

- Date of Leave

- Amount of leave time (i.e. hours)

- Time code will be FMLA WOP only as we don’t need the additional information for FMLA SICK or FMLA VAC etc.

2. The loaded entries may be verified in IPTL

3. Use UPTL to process the entries to the IPTR. NOTE: This creates IPTR batches for each pay period with the transactions in the loaded file as well as creating the leave lines (IAAL)

4. Verify leave line entries in IAAL on the ‘In Payroll’ tab. (Note: You will not see the results in VALB)

5. Break the link between IPTR transactions and the IAAL leave lines that were created above using SQL:

- Update p2k_pr_pay_trans_time_codes set aal_id = NULL

- Where ptr_id in (select id from p2k_pr_pay_transactions where mex_id_generated = <the UPTL MEX_ID>);

Notes#

HL-458

There is no rollover. Once the plan has run it's course, a new IALA will not be created until the next time a transaction is entered.

There are gaps between occurrences of this bank.

- The accrual start date is the date of the first transaction entered

- The accrual end date is 365 days (1 year) in the future, from the start date

Notes prior to HL-458

There are three scenarios that an employee may take FMLA:

- Use FMLA Federal Only: FMLA Sick will be paid via association with the FMLA Federal (can this be worded better? - via association?)

- Use FMLA State Only: FMLA Sick will be paid via association with the FMLA State (can this be worded better? - via association?)

- If FMLA is for Both Federal and State:

- FMLA Sick will be paid via association with the FMLA Federal

- FMLA bank for Federal will be reduced using the timecode taken, such as FMLA_FEDNJ_TKN

- FMLA bank for State will be reduced using the FMLA State LWOP timecode

Set up for the FMLA Federal and FMLA State will require their own Leave Type to be able to add to the Pay Point