Table of Contents

PR_US_IPRLUS_W4_OPTIONS#

This document describes how to set up Federal W4 and State W4 Form on the IPRLUS screen.

IPRLUS screen defines all the tax calculation methods and the W4 Forms set up using Miscellaneous Parameters to facilitate the US Tax Calculation in the UPCALC process via the Symmetry Tax Engine.aintain US Tax Filing Information (IPRLUS) form.

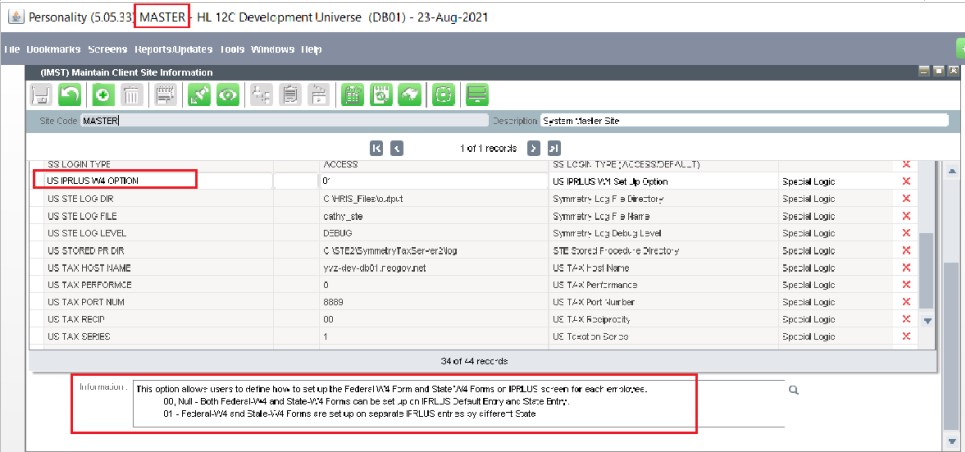

IMST Set Up#

IMST Site Preference - US IPRLUS W4 OPTION#

This IMST Site option allows users to define how to set up the Federal W4 Form and State W4 Forms on IPRLUS screen for each employee.

- On IPRLUS, users have ability to set up all Federal W4 and State W4 Forms information on one entry

- Or users can set up one IPRLUS for Federal W4, and then set up separate State W4 Forms by State.

- Null, 00 - Both Federal-W4 and State-W4 Forms can be set up on IPRLUS Default Entry and State Entry

- 01 - Federal-W4 and State-W4 Forms are set up on separate IPRLUS entries by different State

IMST Screen set up:

- SEED_US_STE_IMST.sql will be delivered starting STE-2021-R9 release

- On IMST, users can manually add this IMST entry if this option is to be used

- On IMST, click the Add icon and the Look Up list to select the Site Preference ‘US IPRLUS W4 OPTION‘

- Users can enter the value of ‘00’ or ‘01’, if other values are specified, the default ‘00’ will be used

- If IMST ‘US IPRLUS W4 OPTION does not exist, the default ‘00’ will be used

IMST - W4 Option Processing#

US IPRLUS W4 OPTION = ‘00’ or Null#

- For option ‘00’, users can set up IPRLUS with all the Federal and State information in one Blank Entry, or in multiple State Entries, or in multiple Tax Jurisdiction Entries

- Each entry must define all the Federal W4 and the State W4 information and tax methods

- UPCALC uses the Pay Header’s Home and Work Jurisdiction to retrieve the appropriate IPRLUS entries

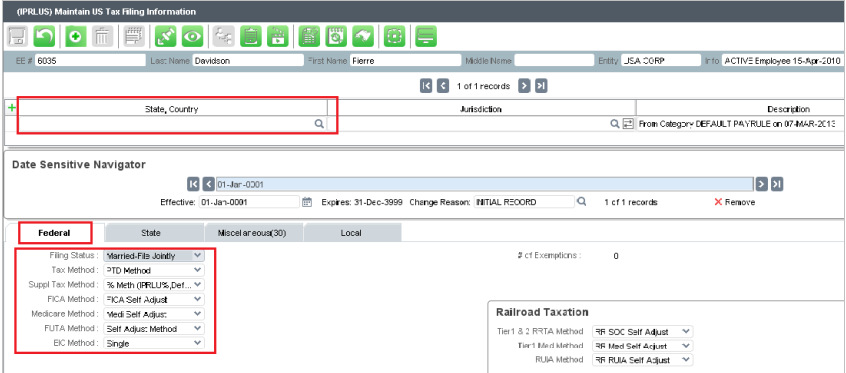

IPRLUS Scenario 1: - Employee uses one default IPRLUS entry only, State = ‘blank’ - Federal / State / Local Tab must define all Tax Methods.

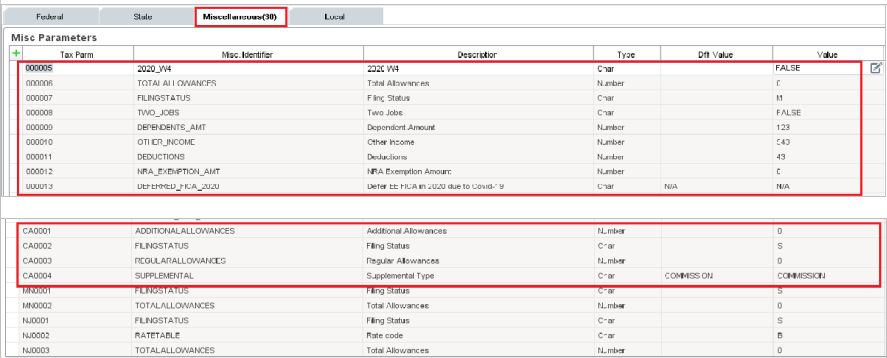

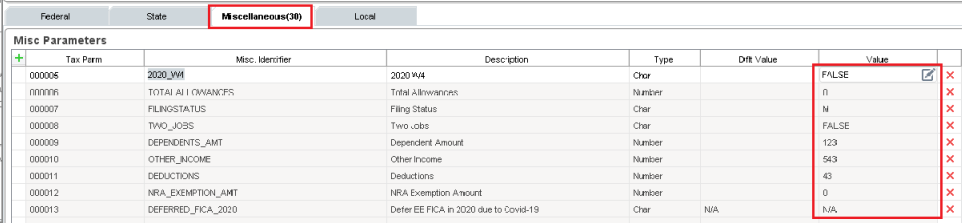

IPRLUS Miscellaneous Tab contains all Miscellaneous Parameters for Federal and all States.

IPRLUS Scenario 2: - Employee can set up one IPRLUS entry for each State, e.g. State = ‘California’, ‘Nevada’ - The Federal / State / Local Tab must define all Tax Methods for each IPRLUS entry.

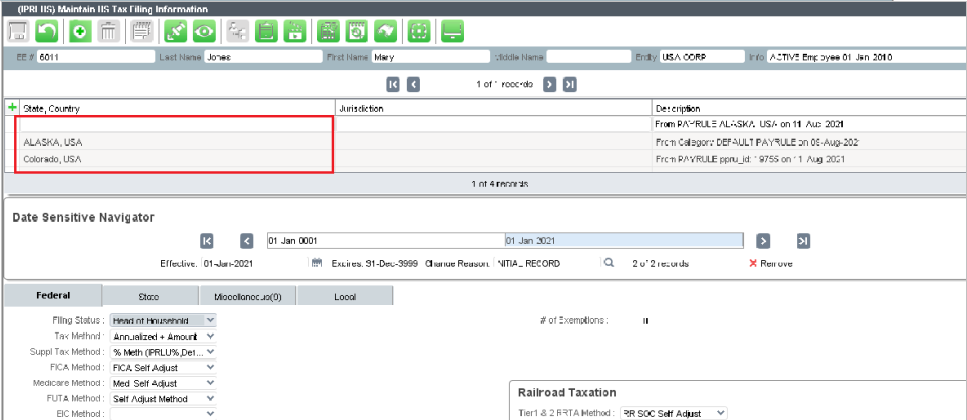

US IPRLUS W4 OPTION – ‘01’#

- For Option ‘01’, Federal tax calculation will be retrieved from the IPRLUS Blank State Entry only

- For State tax calculation, UPCALC uses the Pay Header’s Home / Work Jurisdiction to retrieve the IPRLUS State Entry, these IPRLUS entries should contain one State W4 information along with the State tax methods

IPRLUS Example: Employee has One Blank entry, and several States entries

- Blank State Entry – this is used for Federal Tax, contains Federal Tax methods and Federal W4 Misc. Parms

- State Entries – each State defines its own State Tax methods and State-W4 Misc. Parms

-IMCT ‘UPRLU MAPPING’ contains the Default Miscellaneous Parameters values for Federal and all States -UPCALC will add the IPRLUS Miscellaneous Parameters if any of the Misc. Parm are not exist -For Federal tax calculation, UPCALC retrieves the IPRLUS Entry with Blank State -For State tax calculations, UPCALC uses the Pay Header’s Home State and Work State to retrieve the appropriate IPRLUS entries -if IPRLUS does not exist for the Home State or Work State, UPCALC will automatically create the IPRLUS entry for that State along with the Miscellaneous Parameters from IMCT ‘UPRLU MAPPING’

Maintaining Federal W4 Parm#

IPRLUS – Federal W4 Misc Parm#

US IPRLUS W4 OPTION = ‘00’ or Null

- Federal-W4 Forms and Federal Tax Methods must be entered on all IPRLUS entries

- This option is the Default set up for Legacy clients and those clients who want to maintain IPRLUS under one Default IPRLUS entry

- This option allows users to optionally enter IPRLUS by State to override some State Tax Methods for a particular State

- Note that all the Federal Tax Methods and Federal Misc. Parm must also be entered for each State entry

- Users can change the IMST ‘US IPRLUS W4 OPTION’ from Option ‘00’ to Option ‘01’ if desired.

- If Option ‘00’ is changed to Option ‘01’, UPCALC will automatically generate the State Entries when the employee is being paid with the Pay Header’s Home State and Residence State

US IPRLUS W4 OPTION = ‘01’

- Federal-W4 Forms and Tax Methods must be entered on one IPRLUS Blank State entry only

- The SaaS Agencies users and new users are recommended to use this option

- The IPRLUS State entries are not required to set up the Federal W4 Forms and Federal Tax Methods

Maintaing State W4 Forms#

IPRLUS – State W4 Misc Parm#

US IPRLUS W4 OPTION = ‘00’ or Null

- Both Federal-W4 and State-W4 Forms and Tax Methods must be entered on each IPRLUS entries

- This option is the Default set up for Legacy clients and those clients who want to maintain IPRLUS under one Default IPRLUS entry

- This option allows users to optionally enter IPRLUS by State to override some State Tax Methods for a particular State

- Note that all the Federal Tax Methods and Federal Misc. Parm must also be entered for each State entry

US IPRLUS W4 OPTION = ‘01’

- State-W4 Forms and State Tax Methods must be entered on separate IPRLUS State entry

- The SaaS Agencies users and new users are recommended to use this option

- The IPRLUS State entries do not need to set up the Federal W4 Forms and Federal Tax Methods

- UPCALC will ensure IPRLUS has a Default Blank entry for Federal tax calculation

- UPCALC will ensure IPRLUS has a State entry for IPPH Home State and Work State

- If IPRLUS Blank entry, Home State entry or Work State entry are not set up, UPCALC will automatically create the IPRLUS entry

IPRLUS Example:

- Employee 6035 has one IPRLUS entry with State = ‘blank’ only

- IPPH Work: NY 36-061-975772, Home: NJ 34-003-874296

- UPCALC will create 2 new IPRLUS entries for State: NY and NJ,

- When UPCALC selection criteria for ‘Message Level’ is not for Errors only, then display the following

Notes #

Click to create a new notes pageScreen captures are meant to be indicative of the concept being presented and may not reflect the current screen design.

If you have any comments or questions please email the Wiki Editor

All content © High Line Corporation